The weekend failed to ignite bullish momentum from crypto investors and both Bitcoin (BTC) and Ether (ETH) turned down on Oct. 31. The bulls will now try to achieve the third successive weekly close and the first-ever monthly close above the psychological $60,000 level.

$63,000 is another level of interest for traders because the stock-to-flow creator PlanB, projected this level as the “worst-case scenario” for October. In the recent past, PlanB’s worst-case theory was proven to be correct in August and September.

The journey for the hodlers was not easy as there were several gut-wrenching corrections along the way and each time a handful of analysts called for the end of Bitcoin. However, in hindsight, all these dips turned out to be good buying opportunities.

Today marks the 13th birthday of the Bitcoin white paper released on Oct. 31, 2008, paving the way for possibly the biggest financial disruption.

Let’s analyze the charts of the top-5 cryptocurrencies that could attract traders’ attention in the next few days.

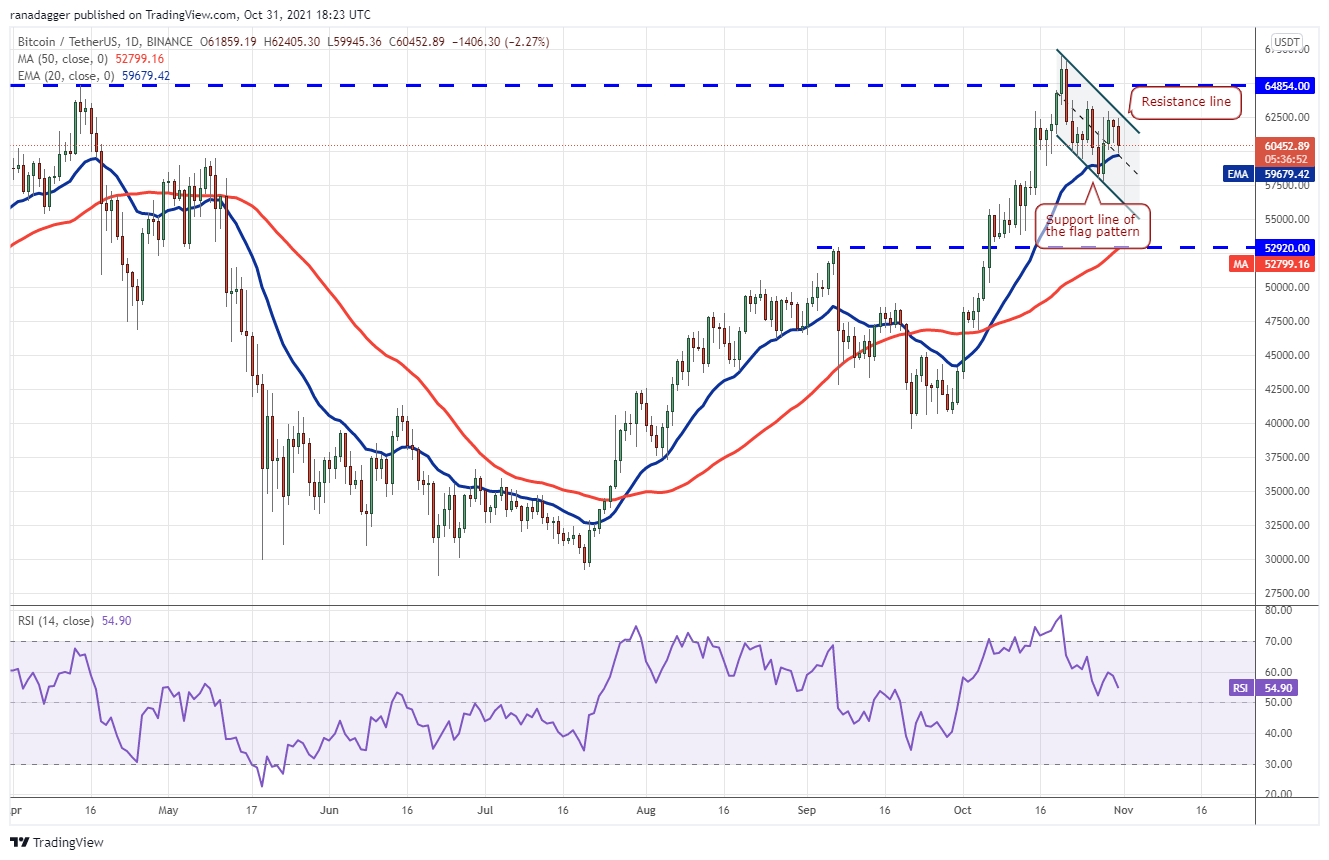

BTC/USDT

Bitcoin has formed a flag pattern but the bulls have not been able to push the price above it. The failure to break the overhead resistance could have prompted selling by short-term traders, which has pulled the price to the 20-day exponential moving average ($59,679).

If the price rebounds off the 20-day EMA, the bulls will make one more attempt to thrust the pair above the flag. If they succeed, the pair could retest the all-time high at $67,000 and then rally toward the pattern target at $89,476.12.

This level is expected to attract strong buying from the bulls. A bounce off the support line could keep the pair inside the descending channel. The bulls will have to push and sustain the price above the resistance line to indicate the possible end of the corrective phase.

ETH/USDT

Ether broke above the all-time high at $4,375 on Oct. 29 but the bulls could not continue the up-move. The bears pulled the price back below the breakout level on Oct. 30, indicating that sellers are active up at higher levels.

If that happens, the pair could resume its journey toward the psychological mark at $5,000. On the contrary, a break below the 20-day EMA could result in a decline to $3,888. If the price rebounds off this level, the pair may remain range-bound for a few days.

The bears will have to pull and sustain the price below $3,888 to gain the upper hand. That could open the doors for a decline to the 50-day SMA ($3,564).

Alternatively, if the price dips below the 50-SMA, a drop to the support line of the channel is likely. A bounce off this level could keep the uptrend intact but a break below the channel will be the first sign that the bulls may be losing their grip.

BNB/USDT

Binance Coin (BNB) broke above the overhead resistance at $518.90 on Oct. 29 but the bulls could not build upon this advantage. This suggests a lack of demand at higher levels.

If the price rebounds off the 20-day EMA, it will suggest that sentiment remains positive and traders are buying on dips. The bulls will then again try to resume the uptrend by driving the price above the overhead zone between $518.90 and $540.50.

Conversely, if the price slips below the 20-day EMA, the correction could deepen and the pair could drop to the 50-day SMA ($431).

If the price breaks below the 20-EMA, it will suggest that the bullish momentum may be weakening in the short term. The pair could then drop to the 50-SMA and next to the neckline of the inverse head and shoulders pattern. A break below this level will indicate a possible change in trend.

Related: What is the worst nightmare that could happen to crypto? Experts answer

MATIC/USDT

Polygon (MATIC) skyrocketed and closed above the overhead resistance zone at $1.71 to $1.79 on Oct. 28, which indicated the start of a new uptrend.

A breakout and close above $2.22 could clear the path for a rally to $2.43 and eventually a retest of the all-time high at $2.70. The rising 20-day EMA ($1.65) and the RSI in the positive territory suggest that bulls are in control.

This positive view will invalidate if bears pull and sustain the price below the 20-day EMA. Such a move will indicate that the recent break above $1.79 may have been a bull trap.

Alternatively, if the price breaks below the 50-SMA, the pair could drop to $1.71. This level is again likely to act as a strong support but if it cracks, the selling could intensify. The pair could thereafter drop to $1.50.

FTM/USDT

Fantom (FTM) broke out to a new all-time high on Oct. 28 but the bulls could not sustain the breakout. The long wick on the day’s candlestick shows that traders booked profits at higher levels.

If they succeed, the FTM/USDT pair could resume its uptrend with the next target objective at $4.10, followed by a move to the psychological level at $5.

Contrary to this assumption, a break below the 20-day EMA will signal that traders continue to dump their positions. The pair could then drop to the 50-day SMA ($1.86). The negative divergence on the RSI suggests that the bullish momentum could be weakening.

A strong rebound off this level will suggest that bulls are attempting to flip this level into support. If that happens, the pair could again attempt to rise to $3 and later to $3.48. This positive view will invalidate if bears pull the price below $2.45.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment