TRADING THE NEWS: NEW ZEALAND RETAIL SALES EX INFLATION

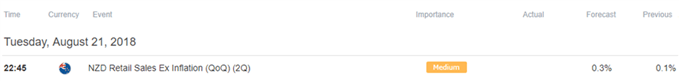

Updates to New Zealand’s Retail Sales report may fuel the recent recovery in NZD/USD as household spending is expected to increase by 0.3% versus the 0.1% during the first three months of 2018.

Signs of stronger consumption may heighten the appeal of the New Zealand dollar as it instills an improved outlook for growth and inflation, and the Reserve Bank of New Zealand (RBNZ) may start to drop its cautious tone over the coming months as ‘employment is roughly around its maximum sustainable level.’

However, another lackluster development may rattle the rebound in NZD/USD as it encourages the RBNZ to keep the official cash rate (OCR) at the record-low, and Governor Adrian Orr & Co. may stick to the current script at the next meeting on September 27 as officials warn that ‘the recent moderation in growth could last longer’.

IMPACT THAT THE NEW ZEALAND RETAIL SALES HAS HAD ON NZD/USD DURING THE LAST PRINT

NZD/USD 15-Minute Chart

Household spending in New Zealand increased 0.1% during the first three months of 2018, with the previous reading revised down to reflect a 1.4% expansion versus an initial reading of 1.7%. A deeper look at the report showed demand for electrical goods increasing 5.4%, with sales of furniture/housewares climbing 2.4%, while discretionary spending on clothing/footwear narrowed 5.0% during the same period.

The New Zealand dollar struggled to hold its ground following the below-forecast print, with NZD/USD dipping below the 0.6900 handle, but the reaction was short-lived as the exchange rate closed the day at 0.6945.

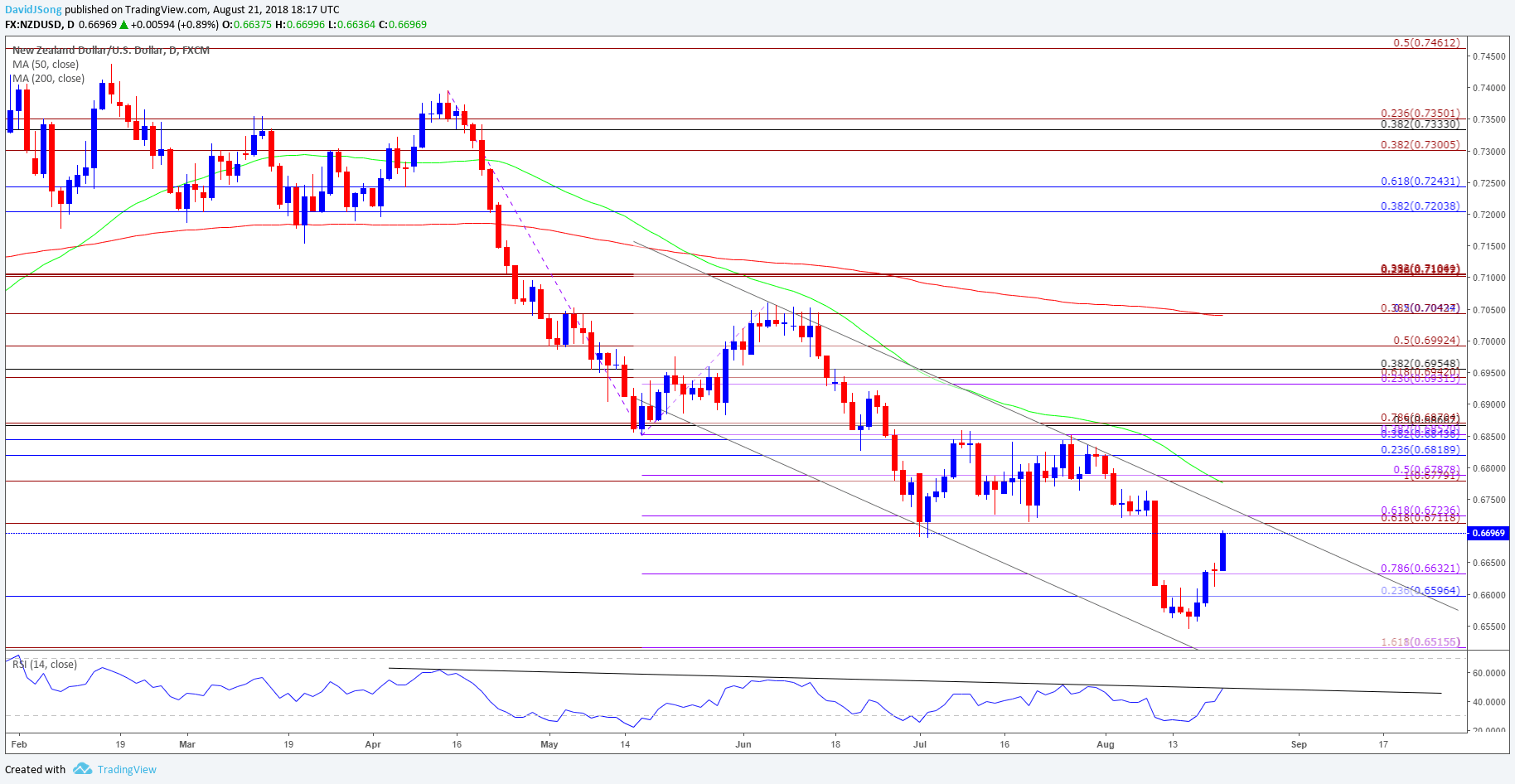

NZD/USD DAILY CHART

Leave A Comment