CANADIAN DOLLAR TALKING POINTS

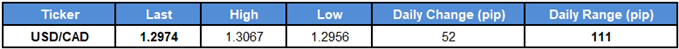

USD/CAD remains under pressure even as the Bank of Canada (BoC) tames expectations for another rate-hike in 2018, and the exchange rate may continue to track the downward trending channel from late-June as it snaps the monthly opening range.

USD/CAD SNAPS MONTHLY RANGE EVEN AS BOC WARNS OF ‘TRANSITORY FACTORS’

USD/CAD has struggled to hold its ground following the unexpected uptick in Canada’s Consumer Price Index (CPI), and the Canadian dollar may exhibit a more bullish behavior over the coming days as updates to the Gross Domestic Product (GDP) report is anticipated to show the growth rate expanding by 3.1% in the second-quarter of 2018.

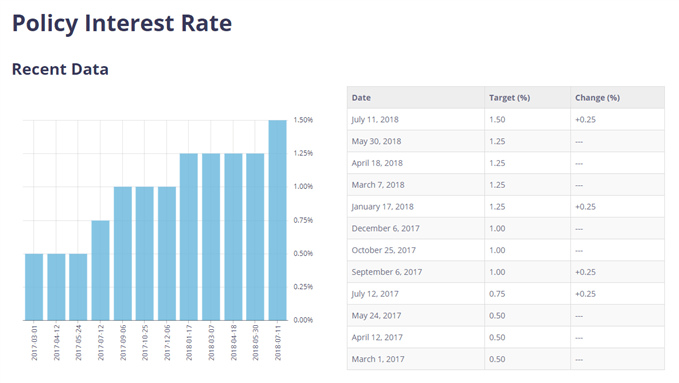

Signs of stronger growth should encourage the BoC to prepare Canadian households and businesses for higher borrowing costs as the central bank is in the process of normalizing monetary policy, and Governor Stephen Poloz & Co. may adopt a more hawkish tone going into 2019 as the ‘Governing Council expects that higher interest rates will be warranted to keep inflation near target’.

However, recent remarks from Governor Poloz suggests the BoC is in no rush to deliver another rate-hike as the recent pickup in price growth is largely driven by ‘transitory factors,’ and it seems as though the Governing Council will retain the current policy at the next meeting on September 5 as the core reading for inflation is ‘very close to target’.

With that said, the BoC may stick to its current approach of delivering two 25bp rate-hikes per year, but positive developments coming out of the region may push the central bank to extend the hiking-cycle as ‘Canada’s economy continues to operate close to its capacity’.

Nevertheless, downside targets remainder on the radar for USD/CAD as it slips to a fresh monthly-low (1.2956), and the exchange rate stands at risk of facing further losses as the bearish momentum appears to be gathering pace. Keep a close eye on the Relative Strength Index (RSI) as it comes up against the upward trend from earlier this year, with a break of trendline support highlighting a bearish signal for dollar-loonie.

Leave A Comment