Fundamental Forecast for Japanese Yen: Bullish

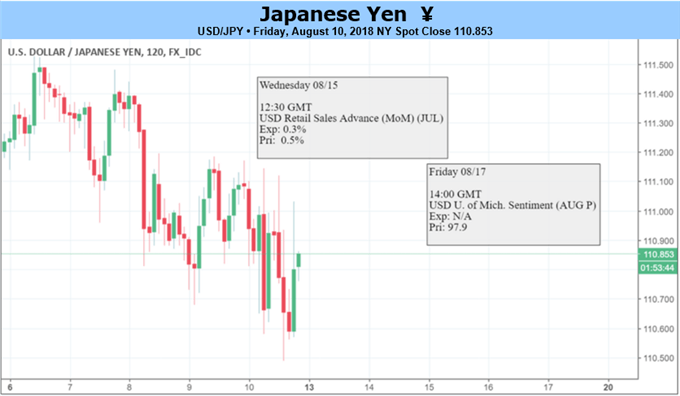

Fresh developments coming out of the U.S. economy have done little to influence the near-term outlook for USD/JPY even as the data prints put pressure on the Federal Open Market Committee (FOMC) to raise the benchmark interest rate, and recent price action raises the risk for a further decline in the dollar-yen exchange rate as it carves a series of lower highs & lows.

The lackluster reaction to the unexpected uptick in the core U.S. Consumer Price Index (CPI) keeps the near-term outlook tilted to the downside, and there appears to be a broader shift in USD/JPY behavior as both price and the Relative Strength Index (RSI) snap the bullish trends from earlier this year.

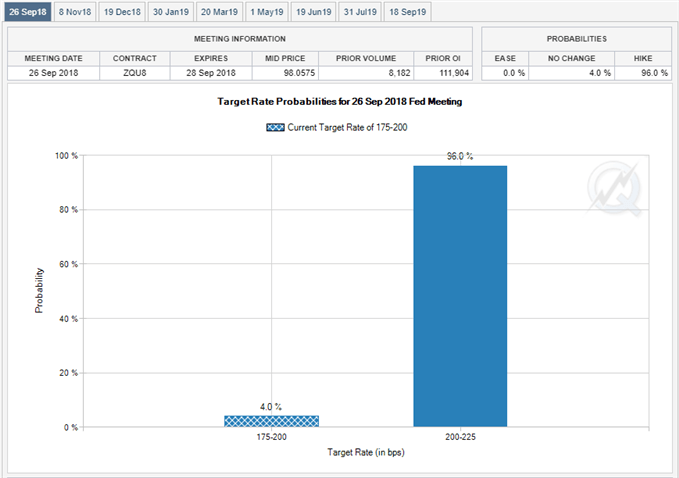

Bear in mind, the data prints should keep the Federal Reserve on track to further normalize monetary policy as Richmond Fed President Thomas Barkin, a 2018-voting member on the FOMC, warns that ‘it is difficult to argue that lower than normal rates are appropriate when unemployment is low and inflation is effectively at the Fed’s target,’ and the central bank may continue to prepare U.S. households and businesses for higher borrowing-costs as Chairman Jerome Powell & Co. largely achieve the dual mandate for monetary policy.

In turn, Fed Fund Futures may continue to reflect expectations for four rate-hikes in 2018 as market participants appear to be gearing up for an adjustment in September and December, but recent price action warns of a larger pullback from the 2018-high (113.18) as the exchange rate and the Relative Strength Index (RSI) track the bearish formations carried over from the previous month.

Looking ahead, attention turns to the U.S. Retail Sales report as household spending is projected to increase 0.1% in July following a 0.5% expansion the month prior, and signs of slowing consumption may ultimately keep USD/JPY under pressure as it dampens the outlook for growth and inflation.

Leave A Comment