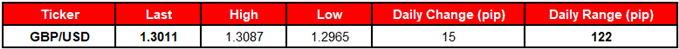

GBP/USD pulls back from a fresh weekly-high (1.3087) even as Bank of England Governor Mark Carney extends his tenure until the end of January 2020, and the pound-dollar exchange rate may continue to consolidate ahead of the central bank meeting on September 13 as the Monetary Policy Committee (MPC) is widely expected to keep the benchmark interest rate on hold.

WAIT-AND-SEE BANK OF ENGLAND (BOE) TO OFFER GBP/USD LITTLE RELIEF

The British Pound is back under pressure following the limited reaction to the U.K. Employment report, and GBP/USD may continue to face headwinds over the remainder of the week if the BoE tames bets for an imminent rate-hike.

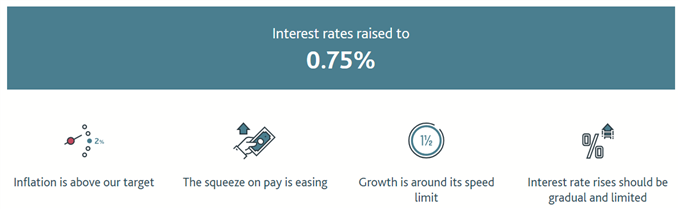

Despite growing hopes for an imminent Brexit deal, the MPC may merely stick to the same script as ‘any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent,’ and the central bank may largely endorse a wait-and-see approach for the remainder of the year after delivering a 25bp rate-hike at its last meeting in August.

Unless the BoE shows a greater willingness to deliver another rate-hike in 2018, the British Pound may find little relief following the meeting, with more of the same from Governor Carney & Co. likely to dampen the appeal of Sterling as it seems as though the MPC will stick to its current course of delivering two rate-hikes per year.

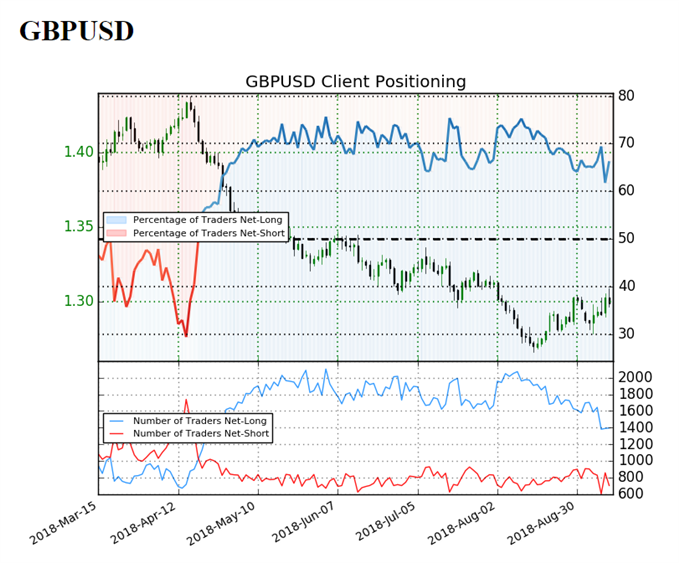

Keep in mind the IG Client Sentiment Report continues to show a skew in retail sentiment as 66.3% of traders are net-long GBP/USD, with the ratio of traders long to short at 1.97 to 1. The retail crowd has been net-long since April 20 when GBP/USD traded near the 1.4050 region even though price has moved 7.8%lower since then. The number of traders net-long is 3.7% lower than yesterday and 17.2% lower from last week, while the number of traders net-short is 5.6% lower than yesterday and 29.7% lower from last week.

Leave A Comment