TALKING POINTS – YEN, US DOLLAR, CHINA, AUSSIE DOLLAR, STOCKS, TURKEY

The markets’ mood brightened in Asia Pacific trade as traders battered by turmoil in emerging market assets were offered a sliver of hope for de-escalation in the trade war between the US and China. That came by way of news that the latter country’s Vice Commerce Minister will travel to Washington to meet a high-level delegation for talks in late August.

Price action was the picture of risk-on recovery. Currencies that rose on the back of deteriorating sentiment – the Japanese Yen, Swiss Franc and the US Dollar – turned lower in tandem. Meanwhile, standby pro-risk alternatives like the Australian and New Zealand Dollars outperformed. Even the Euro, which has been severely pressured by worries about Turkish crisis contagion, managed to find a lifeline.

Looking ahead, a modest offering of second-tier European and US economic data releases seems unlikely to push sentiment trends out of the spotlight. FTSE 100 and S&P 500 futures are pointing firmly higher before the opening bells in London and New York, hinting the upbeat tone has scope for follow-through in the hours ahead. Needless to say however, elevated headline sensitivity threatens the durability of any such move.

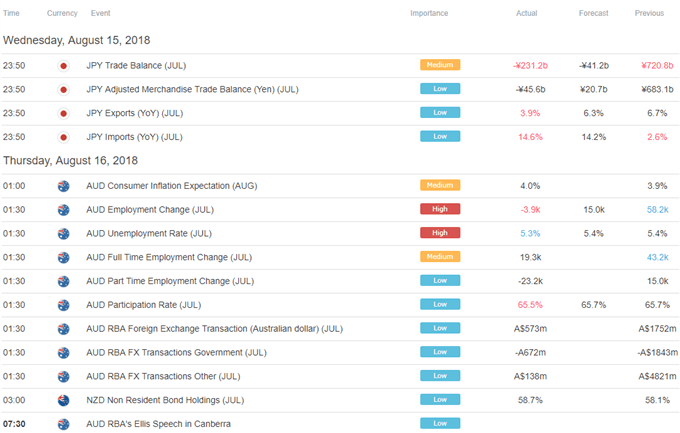

ASIA PACIFIC TRADING SESSION

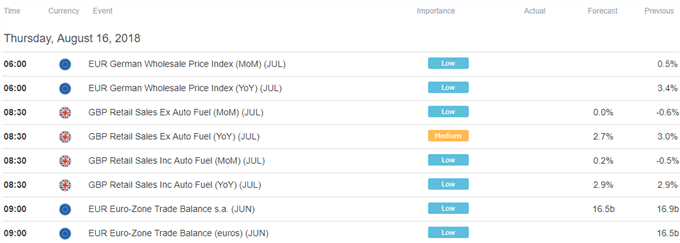

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

Leave A Comment